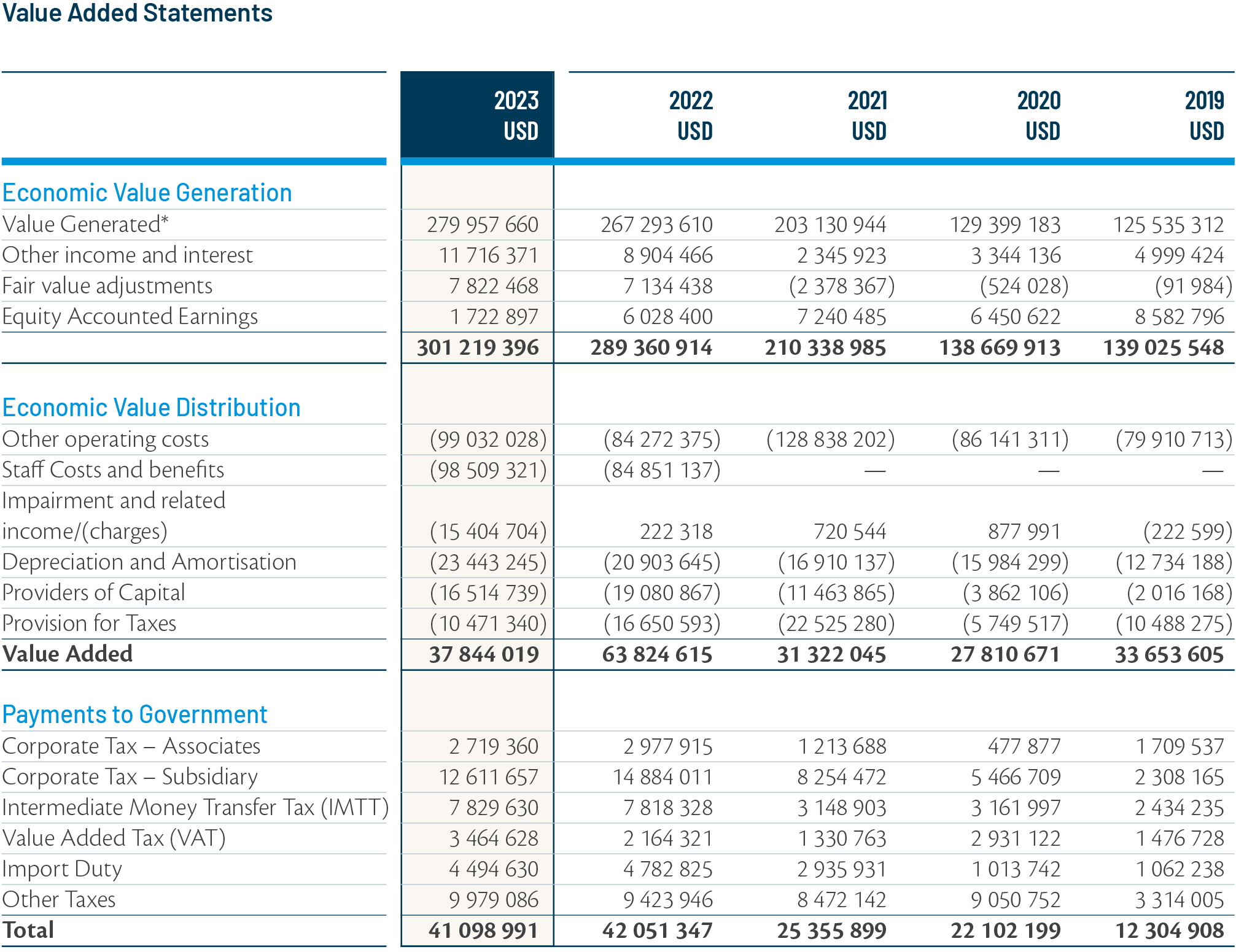

ECONOMIC PERFORMANCE

Overview

The Group makes a significant financial contribution to the national economy through the payment of taxes.

Economic Indicators

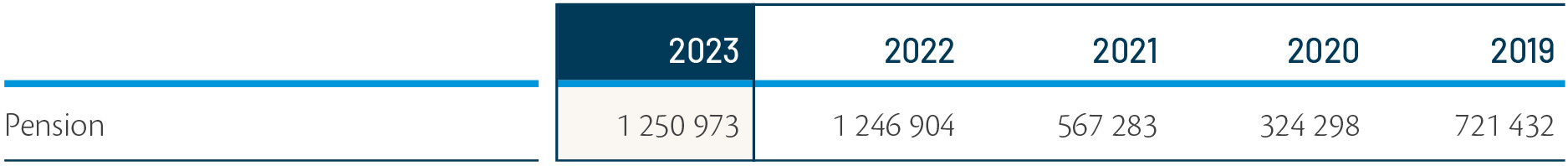

Defined Contribution Pension Plan

The Group ensures that all qualifying employees are members of voluntary and statutory pension schemes managed through self-administered defined contribution pension schemes and the relevant statutory bodies. We manage the Innscor Africa Limited Pension Fund and the National Foods Pension Fund under the Group. Compulsory external schemes comprise the National Social Security Authority Scheme, Workers Compensation Insurance Fund and the Catering Industry Pension Fund.

The total contributions to the schemes for the year is presented below:

Innscor Group’s Payments to Government in F2023

The Group’s total payments to the Zimbabwean Government for F2023 amounted to USD 41 098 991. Key contributions to the fiscal revenue in F2023 were through the payment of Corporate Tax for Subsidiaries (30.69%), Intermediary Money Transfer Tax (IMTT) Tax (19.05%), PAYE 19.03% and Value Added Tax (VAT) payments (8.43%).